A class action suit would allow millions to benefit from the work of a few who take this firm to court and argue for restitution and civil penalties, among other remedies.Īll members of the class nationwide would receive notification about the case, and have the option to participate. This is the first step in a class action suit, which is the most common and easiest way to handle a case with so many potential claimants. While it is still very early in the process, we can expect the courts to approve a nationwide class in this case.

#EQUIFAX DATA BREACH LAWSUIT FREE#

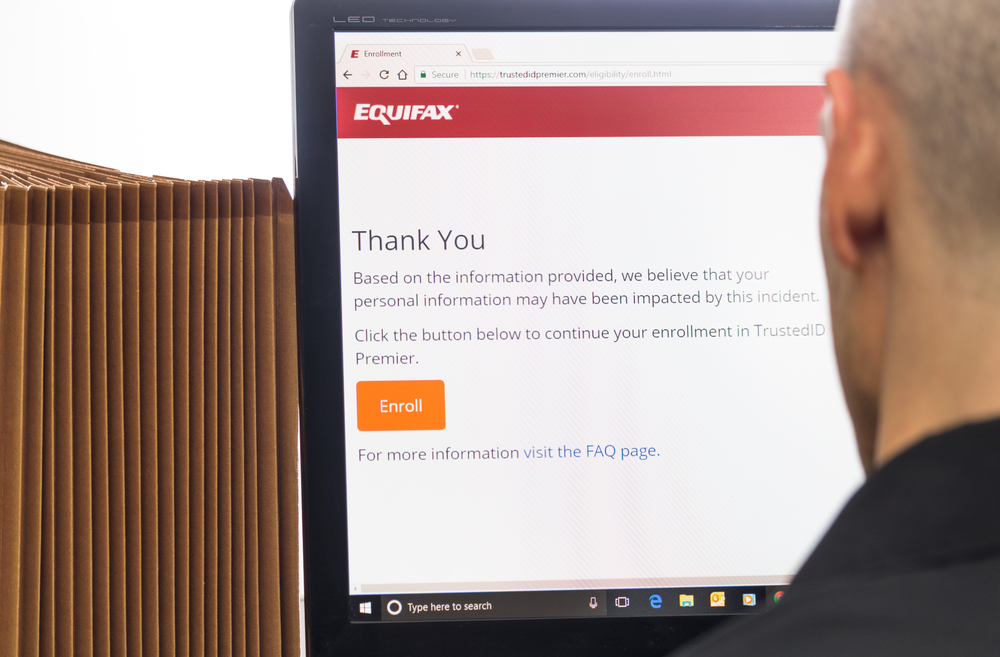

Anyone this breach affected must monitor her credit closely and guard against identify theft for the next several years.Įquifax offered a free year of credit monitors and waived all fees associated with freezing credit records, but this is simply too little too late for many. So far, there have not been any significant reports of widespread identity theft or other use of the compromised information tied to the breach. At the same time, this will negatively affect your credit and your ability to do these things. They may be able to take out a loan based on your credit, or even buy a car or home. They can open a bank account or credit card in your name, or rent an apartment. With this information, nefarious individuals can effectively steal someone else’s identify. Names, birthdates, and Social Security numbers in the hands of hackers and scammers could cost individuals hundreds of thousands of dollars. The very nature of this data makes this breach a serious problem. This was not just names or email addresses. Why Is This Type of Data Breach So Dangerous?īecause of its position as a major credit reporting agency, Equifax collected and kept the personal data of millions of Americans. It offered only partial information and explanation when disclosing the breach.It failed to provide immediate notice of the breach to all affected users.It did not have adequate cybersecurity procedures and protocols to protect personal data.Angry victims whose information Equifax jeopardized are claiming three main failures on the part of the credit reporting firm: This breach affected the information of almost one out of every two adults across the country, and the company hid it from these victims for almost 40 days.

Even worse, Equifax executives admitted they discovered the breach in cybersecurity more than a month earlier, on July 29. When the company announced the breach on September 7, that trust was lost. As one of these agencies, the public trusted Equifax to collect and protect their identifying information as well as private financial details. There are three major credit reporting agencies in the United States. How Did Equifax Fail to Protect the Personal Data of Millions of Americans? We are ready to help our clients hold Equifax responsible for its inexcusable actions. If you are curious about your options for compensation, an Equifax data breach lawsuit lawyer can help.Ĭall Gacovino, Lake & Associates, P.C. Dozens have taken legal action against Equifax, and experts expect thousands of others to join them. Naturally, many of the 143 million people affected are angry the company failed to protect their private personal information. While it is unclear who accessed the information, the available data included names, birthdates, and Social Security numbers. On September 7, 2017, credit reporting company Equifax announced that a breach in security over the summer compromised the personal data and information of millions of Americans.

0 kommentar(er)

0 kommentar(er)